The Risk Dashboard, based on Solvency II data, summarises the main risks and vulnerabilities in the European Union’s insurance sector through a set of risk indicators. The data is based on financial stability and prudential reporting collected from insurance groups and solo insurance undertakings.

Key observations:

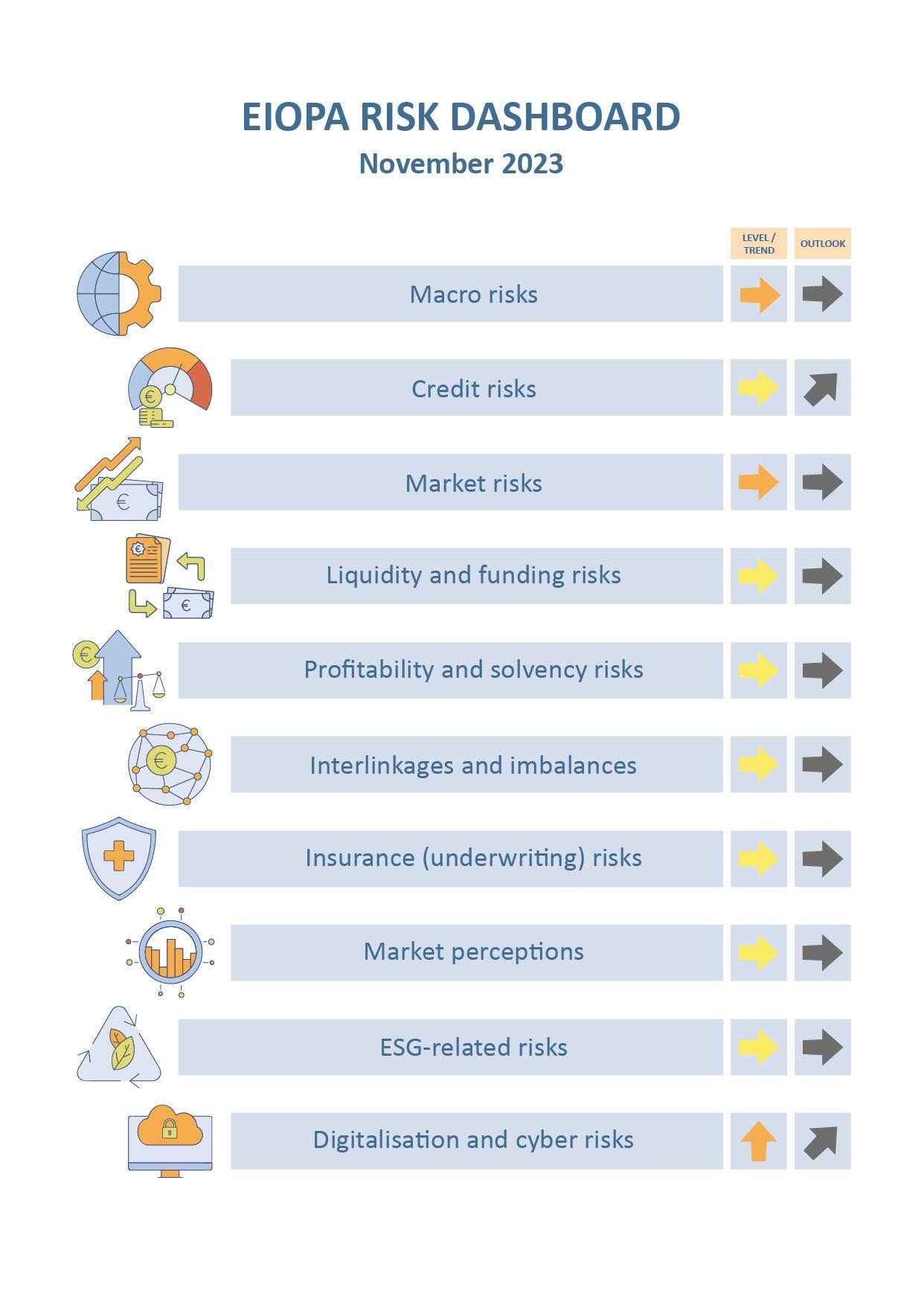

Risks for the European insurance are elevated in the areas of macro, market and cyber, while they remain moderate for the other risk categories.

Macro-related risks remain among the most relevant for the insurance sector as the outlook for the next four quarter GDP growth at global level has deteriorated and credit-to-GDP gap widened. CPI forecasts slightly further decreased.

Credit risks is at medium level with no noticeable changes while market risks are prominent as volatility in equity market increased and bond volatility remain elevated.

Liquidity and funding risks remain stable, with the median of liquid assets ratio slightly improved compared to the previous quarter. On the other hand, bond issuance and catastrophe bond issuance increased.

Profitability and solvency risks moderate slightly on the profitability side as performance indicators increased in the first half of 2023. The distribution of the SCR ratio improved especially for life and groups.

Interlinkages and imbalances risks also are constant. Exposures to banks, insurances and other financial institutions are overall stable, with minor changes in the distributions compared to the previous quarter. Derivatives to total assets and investment in domestic sovereign debt was stable in Q2-2023.

Insurance risks remain at medium level with a positive median year-on-year premium growth for life business, after the negative levels reported in the previous quarters.

Market perceptions show underperformance of non-life insurance stocks when compared to the market for the second quarter of 2023.

ESG related risks remain stable at medium level, as insurers’ median ESG rating score remain unchanged around A-. The median exposure towards climate relevant assets hover around to 3.3% of total assets, on the other hand insurers’ investments in green bonds over total green bonds outstanding decreased compared to the previous assessment. As for physical risks, the exposure at flood risks slightly increased while exposure at windstorm risk slightly decreased between 2021 and 2022.

Digitalization and cyber risks increased to high levels andare expected to further increase according to the supervisory assessment. The frequency of cyber incidents impacting all sectors of activity, as measured by publicly available data, increased since the same quarter of last year. Cyber negative sentiment also indicates an increasing concern in the third quarter of 2023.

Note:

- Reference date for company data is Q2-2023 for quarterly indicators and 2022-YE for annual indicators. The cut-off date for most market indicators is end September 2023.

- Risk Levels are based on a 4-level scale from Low (green) to Very high (red). Risk trend reports the quarter on quarter variation of the risk based on a 5-level scale from Substantial Decrease to Large Increase.

Source : European Insurance and Occupational Pensions Authority